- A FinTech Marketing Strategy India Can’t Ignore

- Understanding the Indian FinTech Consumer: Beyond the Metros

- Core Pillars of a Winning FinTech Marketing Strategy in India

- Content Marketing That Builds Trust and Educates

- Hyper-Personalization with AI and Data Analytics

- The Power of Vernacular and Regional Influencer Marketing

- A Mobile-First Digital Experience is Non-Negotiable

- Navigating the Regulatory Maze: Marketing with Compliance

- Measuring What Matters: KPIs for FinTech Success

- Charting Your Course to FinTech Leadership

A FinTech Marketing Strategy India Can’t Ignore

A FinTech marketing strategy India can leverage for success is no longer a matter of simply running digital ads. In a market projected to reach a value of $1 trillion by 2030, the competition is ferocious, and the consumer is more discerning than ever. The explosion of UPI transactions, the rise of digital-native investors, and the government’s push for a cashless economy have created a fertile ground for innovation. However, this gold rush also means that generic, one-size-fits-all marketing playbooks are destined to fail. To capture market share and build a sustainable brand, FinTech companies must deploy a nuanced, data-driven, and deeply localized strategy that resonates with the unique pulse of the Indian subcontinent.

Understanding the Indian FinTech Consumer: Beyond the Metros

For years, the FinTech focus was squarely on the English-speaking, high-income consumers in Tier-1 cities like Mumbai, Bengaluru, and Delhi. That paradigm has irrevocably shifted. The next wave of growth—the “next billion users”—is emerging from India’s Tier-2 and Tier-3 cities and even rural heartlands. This demographic is fundamentally different. They are mobile-first, often accessing the internet exclusively through their smartphones. They are value-conscious, highly sensitive to fees, and seek tangible benefits.

Most importantly, they operate on a foundation of trust. They are more likely to adopt a new financial app based on a recommendation from their local community or a trusted regional influencer than a high-budget celebrity campaign. According to a report by the Boston Consulting Group, digital adoption is soaring in smaller towns, with a significant portion of new users coming from non-metro areas. This reality demands a marketing approach built on vernacular communication, regional cultural understanding, and solutions that address hyper-local financial needs.

Core Pillars of a Winning FinTech Marketing Strategy in India

To build a brand that not only acquires users but retains them, marketing efforts must be built on several key pillars tailored to the Indian context.

Content Marketing That Builds Trust and Educates

In a country where financial literacy levels are still developing, the most successful FinTech brands act as educators first and service providers second. A robust content strategy is the cornerstone of building this trust. This means moving beyond simple product promotions and creating valuable content that demystifies complex financial topics.

Think blog posts explaining “How to check your CIBIL score for free,” short-form videos on Instagram Reels or YouTube Shorts breaking down the concept of SIPs in Hindi or Tamil, or webinars on tax-saving investments. By empowering users with knowledge, you position your brand as a credible authority and a genuine partner in their financial journey. This educational approach directly addresses user pain points and builds a loyal following that sees your brand as more than just a transactional platform.

Hyper-Personalization with AI and Data Analytics

The modern Indian consumer expects a personalized experience. Leveraging Artificial Intelligence and data analytics allows FinTech companies to move from mass messaging to one-to-one communication. By analyzing user transaction data, spending habits, and in-app behavior, you can deliver hyper-personalized product recommendations, customized notifications, and relevant financial insights.

For instance, a payments app can offer a tailored cashback deal at a user’s most-frequented local store, or a lending platform can proactively offer a pre-approved credit line based on a user’s healthy financial history. However, this must be balanced with unwavering commitment to data privacy and transparency, adhering strictly to the guidelines set forth by regulators like the Reserve Bank of India (RBI).

The Power of Vernacular and Regional Influencer Marketing

The era of pan-India celebrity endorsements is waning in effectiveness for building grassroots trust. Today’s winning strategy involves collaborating with regional micro- and nano-influencers. These are creators who have a deep, authentic connection with their audience in specific linguistic and cultural pockets.

A finance influencer from Pune explaining mutual funds in Marathi or a YouTuber from Chennai reviewing a trading app in Tamil will drive higher engagement and conversion than a Bollywood star in a generic ad. These influencers are seen as peers. Their endorsement is a powerful form of social proof that can significantly lower customer acquisition costs and build a strong community around your brand.

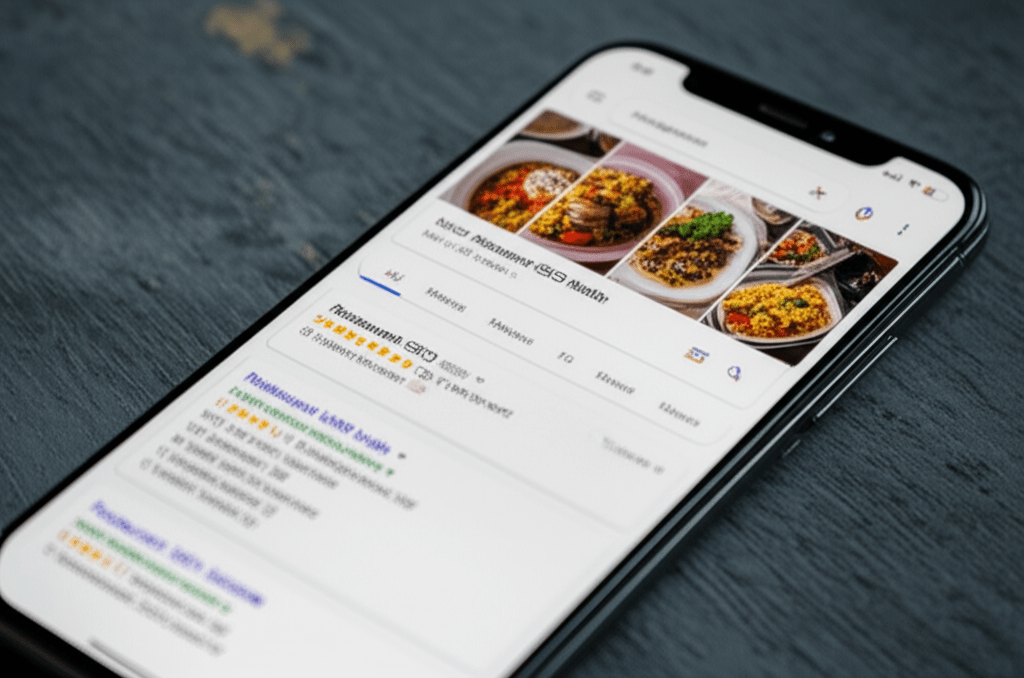

A Mobile-First Digital Experience is Non-Negotiable

India is not just mobile-first; for many, it’s mobile-only. Your app or mobile website is your primary storefront, and its performance is critical. A seamless, intuitive, and fast-loading digital experience is not a luxury—it’s a basic requirement. This involves more than just a responsive design; it means creating a lightweight application that functions smoothly on low-end smartphones and on fluctuating network conditions common across the country. A clunky user interface or a slow onboarding process can lead to uninstalls before a user even completes their first transaction. Investing in a superior web and app design that prioritizes user experience is one of the highest-leverage decisions a FinTech company can make.

Navigating the Regulatory Maze: Marketing with Compliance

The Indian FinTech space is closely monitored by regulatory bodies like the RBI and SEBI to protect consumer interests. Marketing strategies must be built with compliance at their core. All advertising claims must be transparent, accurate, and devoid of misleading information. Regulations surrounding KYC (Know Your Customer) norms, data storage, and the communication of interest rates or investment risks are stringent. Any marketing campaign, especially in lending and investment sectors, must be vetted by legal and compliance teams to avoid severe penalties and reputational damage.

Measuring What Matters: KPIs for FinTech Success

To ensure your marketing budget is driving real growth, it’s crucial to track the right Key Performance Indicators (KPIs). Move beyond vanity metrics like app downloads or social media likes and focus on what truly impacts the bottom line:

Customer Acquisition Cost (CAC): How much does it cost to acquire one new, active customer?

Customer Lifetime Value (CLV): What is the total net profit your business will make from a single customer?

Conversion Rate: What percentage of users who install the app complete the onboarding and perform their first transaction?

Churn Rate: What percentage of customers stop using your service over a given period?

* Average Revenue Per User (ARPU): How much revenue, on average, does each active user generate?

Tracking these metrics provides a clear picture of your marketing ROI and the overall health of your business, enabling you to optimize campaigns for sustainable profitability.

Charting Your Course to FinTech Leadership

The Indian FinTech market is a landscape of immense opportunity, but it rewards only those who approach it with strategic precision. A winning blueprint is one that is deeply localized, data-driven, education-focused, and relentlessly user-centric. It requires a deep understanding of diverse consumer segments and the agility to adapt to a rapidly evolving digital and regulatory environment.

Building a marketing engine that navigates this complex terrain and delivers scalable results demands specialized expertise. If you are ready to elevate your brand from just another app to a trusted financial partner for millions of Indians, it’s time to work with a team that understands the nuances of digital growth. To craft a bespoke strategy for your FinTech brand, you can consult Rank Raptor here.